September Natural Gas Futures in the Red After Higher-Than-Expected Storage Injection

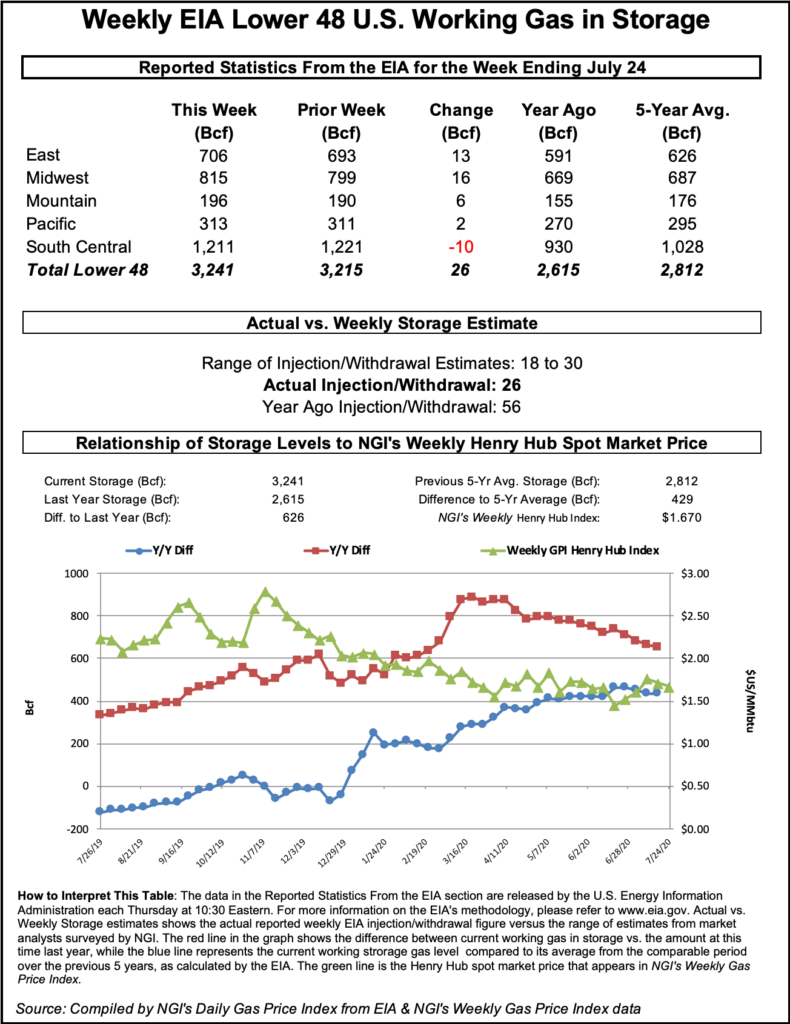

The U.S. Energy Information Administration (EIA) reported an injection of 26 Bcf into storage for the week ending July 24, a print that came in slightly above the average of major polls and pushed Nymex natural gas futures lower.

The result implies that demand, lifted by summer heat and strong energy use for cooling, is realigning with supply following months of imbalance caused by the coronavirus pandemic, observers said.

“It was hotter than normal over much of the U.S., especially the East,” NatGasWeather said of this week’s EIA report period.

The latest injection marked the fifth consecutive week of sub-100 Bcf builds and the lowest figure of the summer. EIA reported an injection of 37 Bcf for the week ending July 17 and a build of 45 Bcf for the week ending July 10.

The improvement, however, has been gradual and weather-dependent, given that demand for liquefied natural gas (LNG) exports remains weak relative to pre-pandemic levels. Once heat subsides, a resurgence in LNG may be needed to “save the day” in the fall, said one participant on The Desk’s online energy platform Enelyst.

Ahead of the EIA report, the September contract was down 4.1 cents at $1.889/MMBtu. The prompt month declined further to around $1.875 when the EIA data was released. By 11 a.m. ET, the September contract was trading at $1.853.

Prior to the report, a Bloomberg survey showed a median prediction of 23 Bcf based on estimates ranging from 18 Bcf to 30 Bcf. A Wall Street Journal poll found a low estimate of 18 Bcf and a high of 33 Bcf, with an average of 25 Bcf. NGI predicted a build of 24 Bcf.

The build for the July 24 week lifted inventories to 3,241 Bcf. The build exceeded the year-earlier level of 2,615 Bcf and the five-year average of 2,812 Bcf.

The latest data “point our models over 4.0 Tcf for end-of-season storage levels,” Bespoke Weather Services said.

By region, the Midwest build was 16 Bcf, with the East at 13 Bcf, according to EIA. Mountain region stocks rose by 6 Bcf, and Pacific inventories grew by 2 Bcf.

The South Central region posted a withdrawal of 10 Bcf; the level at nonsalt facilities was flat, with salts accounting for all of the change, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |