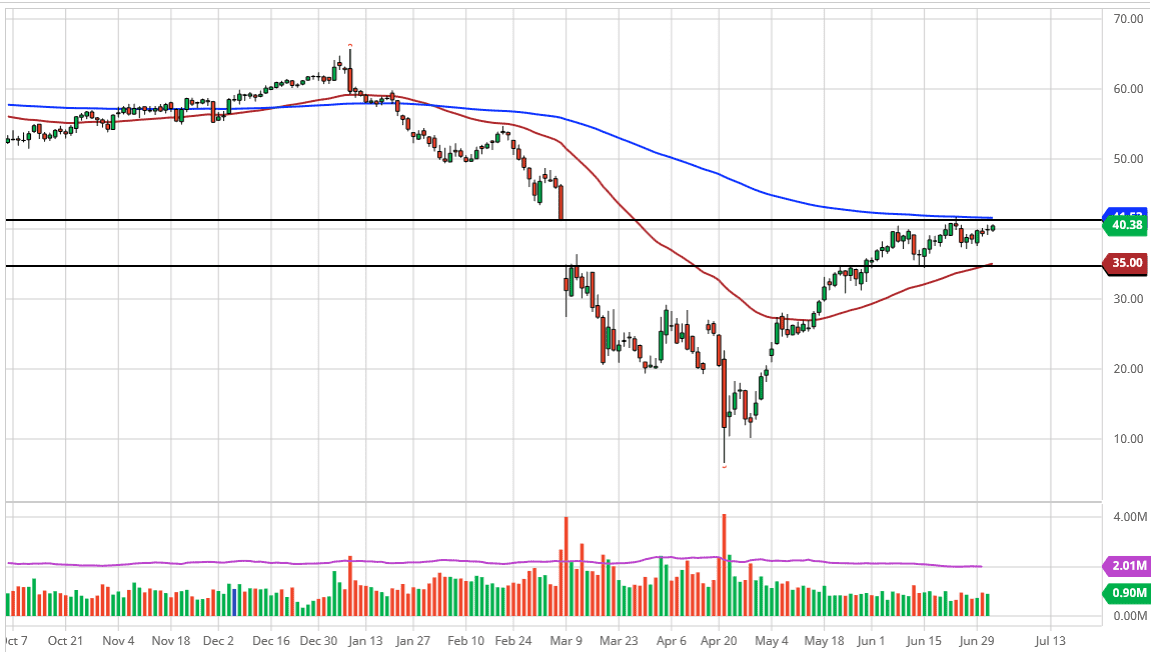

Looking at the West Texas Intermediate Crude Oil market, you can see that we have rallied ever so slightly but at the end of the day we are still very much in the same range that we have been in for some time. After all, we are stuck between a couple of major moving averages in the form of the 200 day EMA, and of course the 50 day EMA. In other words, a lot of technical traders are going to be looking at both the short and long side of this market. This breeds a perfect scenario for sideways trading as we have seen continuing.

I do believe that the market will ultimately make a decision, and right now it even looks as if the upside is probably the more likely direction given enough of a catalyst. However, do not be surprised at all to see a bit of a pullback in order to get there. After all, it is a major barrier to overcome so it should not be surprising that we need to take a couple of attempts to make it happen. It is the top of a major gap, which of course typically signifies major resistance. Having said all of that, if we were to break above there then it is likely that we will go looking towards the $49 level. That is an area that had seen significant selling previously, so this of course makes quite a bit of sense.

To the downside there is significant support at the $35 level, which was the previous bottom of the gap. We also have the 50 day EMA in that same neighborhood, so I think that those two factors are reason enough to see the area offer a certain amount of support. I do not necessarily think that we are going to break down below it, but if we did do so then it is likely we go looking towards the $30 level after that. Keep in mind that the oil market does tend to like $10 ranges, so I think that is what we are trying to do right now, find that range. If we cannot break above the $40 level significantly, or perhaps more specifically the 200 day EMA, then we could see a range between roughly $30 and $40, but it looks as if the market is going to try to break out to the upside at least one more time.